Giggle Corner

Your cozy hub for prep, clarity, and a few well-timed giggles. Whether you’re gearing up for tax season, onboarding payroll, or planning a strategic clarity session, Giggle Corner is here to help you feel ready—with guides, tips, and a wink of warmth.

Giggle Sheets

Our prep guides help you gather what you need and know what to expect. They’re clear, friendly, and designed to make your next step feel like a breeze.

- Tax Prep Giggle Sheet: What to bring, what to expect, and how to make it smooth.

- Payroll Setup Giggle Sheet: Get your team info organized and ready to roll.

- Strategic Clarity Giggle Sheet: Prep your questions, goals, and big-picture thinking.

Coming soon: downloadable PDFs and personalized versions based on your services.

Tax Prep Giggle Sheet

Tax Tips That Make You Smile

Tax season doesn’t have to be stressful—or dull. At Count Giggles CPA, we believe a little laughter makes financial planning easier. That’s why we created the Tax Prep Giggle Sheet: a cheerful collection of quick, practical tips designed to keep you informed and smiling.

Each month, we highlight fresh advice to help you stay organized, save money, and feel confident about your taxes. And because we know a giggle goes a long way, we’ve sprinkled in a touch of humor to brighten your day.

This Month’s Giggle Sheet

December Tax Tip

Maximize your deductions before December 31!

If you’re a cash-basis taxpayer, consider prepaying up to 12 months of business expenses—like rent, insurance, or subscriptions—to claim the full deduction this year. It’s a smart way to reduce your taxable income while setting yourself up for a strong start in 2026.

Track That Mileage Like a Boss

If you drive for business, charity, or medical reasons, those miles could mean deductions.

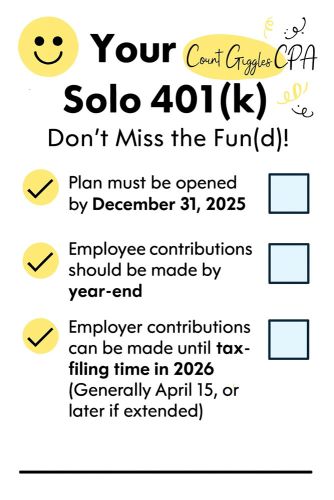

Pro tip: Keep a notebook in your glove box or use a mileage app. No more guessing!Solo 401(k) = Superpower

Self-employed? A Solo 401(k) lets you save as both employer and employee.

Translation: You get to wear both hats—and deduct both contributions.

Save Those Receipts (Even the Weird Ones)

From printer ink to postage, small expenses add up.

Yes, even that juice you bought for your client meeting counts.

Charitable Giving = Feel-Good Deduction

Donations to qualified nonprofits are deductible—but only if you keep records.

A thank-you letter from the charity is your golden ticket.

Quarterly Payments = Peace of Mind

If you owe more than $1,000 in taxes, estimated payments help you avoid penalties.

Think of them as your financial vitamins—take them quarterly for best results.

Giggle of the Week

Why did the accountant cross the road?

To balance both sides of the ledger!

Stay Connected

We update the Giggle Sheet regularly, so check back for fresh tips and a little levity. You’ll also see the latest Giggle Sheet linked in your appointment reminders, so you’re always prepared with a smile.

Download This Month’s Giggle Sheet PDF

What to Bring to Your Tax Meeting

- W‑2s, 1099s, and other income statements

- Receipts for deductible expenses (business, medical, charitable)

- Mileage logs or travel records

- Retirement contribution statements

- Last year’s tax return

- Records of major life changes (new job, home purchase, marriage, etc.)

- A list of questions you’d like answered

Helpful Hints

- Organize documents in folders or envelopes by category

- Bring digital copies if that’s easier—we accept both

- Note any major life changes (new job, home purchase, marriage, etc.)

- Keep a running list of questions so we can cover everything

What to Expect

- A warm, welcoming conversation—we make taxes approachable

- Clear explanations of deductions, credits, and strategies

- Guidance tailored to your situation, with no jargon

- Action steps to keep you confident and prepared all year long

✨ Count Giggles CPA — Making tax prep approachable, stress‑free, with a side of giggles ✨

Payroll Setup Giggle Sheet

This sheet helps you gather the right details to set up payroll smoothly—whether you’re hiring your first employee or streamlining an existing system.

What to Bring

- ✅ Legal business name and EIN

- ✅ State registration and tax account numbers

- ✅ Employee names, addresses, and SSNs

- ✅ Compensation details (salary, hourly rate, bonuses)

- ✅ Start dates and work schedules

- ✅ Bank account info for direct deposit

- ✅ Any benefit deductions (health, retirement, etc.)

Helpful Extras

- Employee classification (W-2 vs. 1099)

- Signed W-4s and I-9s

- Pay schedule preferences (weekly, biweekly, monthly)

- Notes on any special arrangements or reimbursements

What to Expect

- A clear setup process with no guesswork

- Guidance on compliance and best practices

- A payroll system that fits your business

- A few giggles along the way

Strategic Clarity Giggle Sheet

This sheet helps you reflect, organize, and arrive ready to make the most of your clarity session—whether you’re planning for growth, simplifying systems, or just untangling the financial spaghetti.

What to Bring

- ✅ A brief summary of your current situation (business, finances, goals)

- ✅ Any recent changes or challenges (new services, staffing, systems, etc.)

- ✅ Questions you’ve been sitting on (big or small)

- ✅ Documents or reports you’d like reviewed (optional)

- ✅ Your calendar or timeline for upcoming decisions

Helpful Extras

- A list of goals or priorities (short-term and long-term)

- Notes on what’s felt unclear or overwhelming

- Any metrics or numbers you’re tracking (even if they’re messy)

- ✏️ Ideas you’re considering but haven’t acted on yet

What to Expect

- A calm, focused conversation with space to think

- Strategic insights tailored to your goals

- Action steps you can actually take

- A few giggles along the way

️ Before We Meet

Not sure what to bring to your session? We’ve got you. From first-time consults to annual reviews, we’ll guide you through what’s helpful to have on hand—and what you can leave to us.

- Recent financial documents (we’ll tell you which)

- Questions, goals, or concerns—big or small

- Your favorite beverage (optional, but encouraged)

What to Expect

We believe in clear communication and zero surprises (unless they’re good ones). Here’s what you can expect when working with us:

- Warm, professional guidance from start to finish

- Clear timelines and next steps

- Resources that make financial planning feel doable

Request a Giggle Sheet

Let us know what service you’re prepping for, and we’ll send the right Giggle Sheet your way. You can also request a personalized version based on your goals.